In the quest for home, every journey begins with a single step. Finding the right mortgage lender is like uncovering the Rosetta Stone of real […]

Author: admin

Rate Cuts 2024: Understanding the Impact on Mortgage Industry

Understanding the ‘Rate Cuts 2024’ scenario is paramount for mortgage professionals seeking to successfully navigate the implications of this economic shift. Understanding the Fed’s Strategy […]

Unlocking Home Equity Loans: What You Need to Know

Unlock your property’s potential value with home equity loans; a potent financial solution tailored for VA homebuyers for 2023. Understanding Home Equity Loans Home equity […]

2023 Mortgage Refinancing Rates: Find Your Best Option

Your 2023 roadmap to navigate the evolving landscape of mortgage refinancing rates, comprehending the critical terminologies and strategies tailored for VA homebuyers and refinancers. Understanding […]

Navigating VA Home Loan Interest Rates in 2023: The Best Refinancing Options

Introduction VA Home Loans In 2023, veterans and active military personnel seeking to own a home or refinance their existing mortgages face a unique set […]

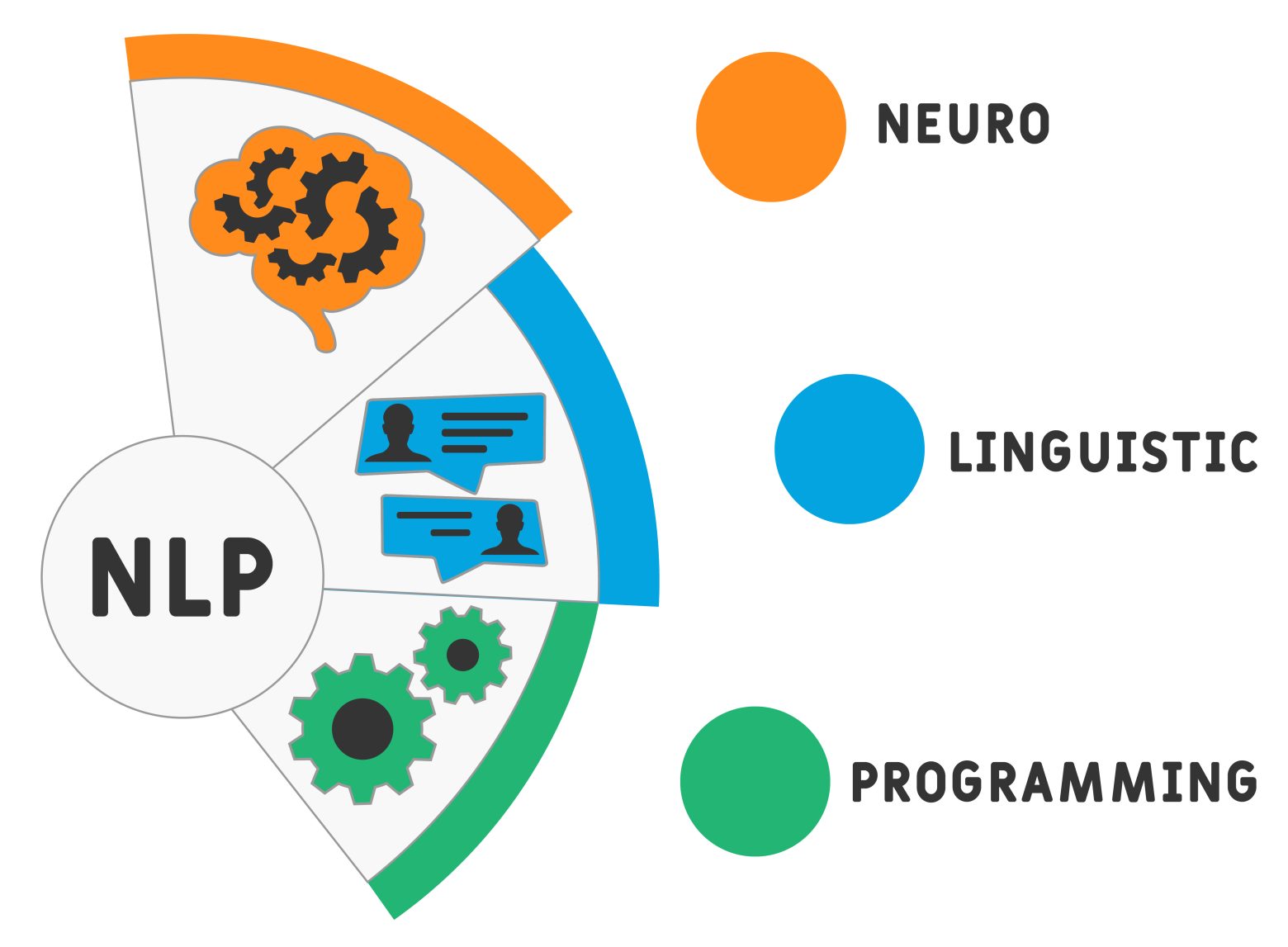

Unleashing the Power of Neuro-Linguistic Programming (NLP) in Real Estate and Mortgage Marketing

In the ever-evolving landscape of real estate and mortgage lending, staying ahead of the competition is crucial. With advancements in technology and shifts in consumer […]

Flagstar Bank Files $21 Million Lawsuit Against Hometown Lenders for Loan Default

In a stunning legal battle that has sent shockwaves through the financial industry, Flagstar Bank, a prominent Michigan-based financial institution headquartered in Troy, has taken […]

Expect a Drop in Mortgage Rates | UBS’s Latest Federal Reserve Predictions Could Benefit Homeowners

Loan Rates Expected to Drop: UBS’s Federal Reserve Predictions Could Benefit Homeowners Implications of UBS’s Federal Reserve Predictions UBS’s forecast signals that the Federal Reserve […]

Union Home Mortgage Files Lawsuit Against Ohio Rival

Peer into the storm of competition brewing between Union Home Mortgage and Go Mortgage and how it unravels potent implications for the mortgage industry. Background […]

WeWork’s Bankruptcy: A Dive into Its Multi-Dimensional Aftermath and the Real Estate Sector’s Road Ahead

Introduction The recent news of WeWork’s filing for bankruptcy represents a significant inflection point in the world of commercial real estate and startup ecosystems. Once […]